EXECUTIVE MANAGEMENT

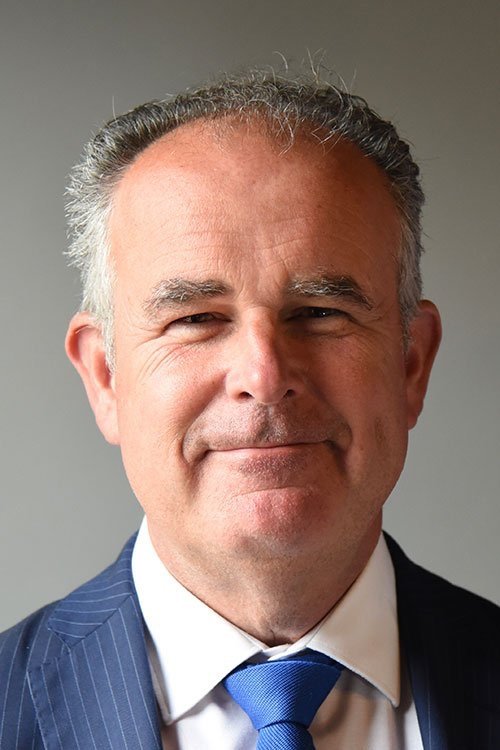

Paul Price

Chief Executive Officer

Damien Varley

Chief Operating Officer

Dominik Kremer

Head of Sales

Tim Markham

Chief Risk & Compliance Officer

John O’Sullivan

Venture Partner

SENIOR MANAGEMENT

Eugene O’Callaghan

Senior Advisor

Suzanne Finnegan

Head of Product Marketing

Liam Price

Senior Relationship Analyst

Margot Lyons

Senior Risk Advisor

Kikuo Kuroiwa

Partner, Japan

Daniel Lawlor

Senior Regulatory Advisor

Marianna Stratigos

Head of Business Development Services

Conor O’Brien

Sales & Operations Analyst

GLOBAL DISTRIBUTION COVERAGE

Haven Green Investment Management has a highly experienced distribution team covering all major EEA countries. For Non-EEA regions, Haven Green partners with authorised parties providing a consolidated global distribution offering.

Japan

Haven Green covers distribution services throughout Japan.

Australia/New Zealand

Haven Green Financial Services Ltd provides distribution cover throughout Australia and New Zealand.

Europe

Haven Green covers Ireland, UK, Germany, France, Italy, Netherlands, Denmark, Finland, Norway, Sweden, Belgium, Spain, Portugal, Iceland and Austria.

South Africa

Haven Green provides distribution cover in South Africa through strategic partners Investment Spectrum.

HAVEN GREEN INVESTMENT MANAGEMENT BOARD OF DIRECTORS

Kieran Walsh

Chairman & Independent Non-Executive Director

Aedin O’Leary

Independent Non-Executive Director

Grainne Dooley

Independent Non-Executive Director

Paul Price

Executive Director

Damien Varley

Executive Director